CYBER CHARTER ADVERTISING

New Report Finds Staggering, Exponential Increase in Cyber Charter Asset Hoards from 2018-2022 and More Than $21 Million Spent on Advertising and Gift Cards in a Single Year

Property taxes paid by home and business owners in school districts across the commonwealth are being used to fund cyber charter school asset hoards, property purchases, and advertising.

All of the 2022-2023 cyber charter advertising information can be found here

KEY FINDINGS INCLUDE:

Pennsylvania’s four largest cyber charter schools reported a staggering 92,000% increase (or an increase of 921x) in their assets from 2018-2022.

- In 2018, Pennsylvania’s four largest cyber charter schools reported a total of $566,858 in the net assets or fund balance category on their Form 990s.

- In 2022, they reported net assets or fund balance of $486 million.

An inventory of properties demonstrates that Commonwealth Charter Academy is amassing a real estate empire across the commonwealth that is funded by property taxes paid by homeowners in school districts that cannot afford to fix and maintain their own buildings.

- Our report details 35 locations that CCA owns and occupies and nine others that they lease. CCA has purchased 29 buildings since 2018 (See full report).

- CCA paid a total of $88.7 million for the properties it currently owns. Those properties have assessed values totaling $43.1 million.

Our findings indicate inconsistent reporting patterns across the AFR and Form 990 filings, which highlights the need for forensic audits to provide a full understanding of the financial standing of the schools and to ensure that spending has been in compliance with state laws.

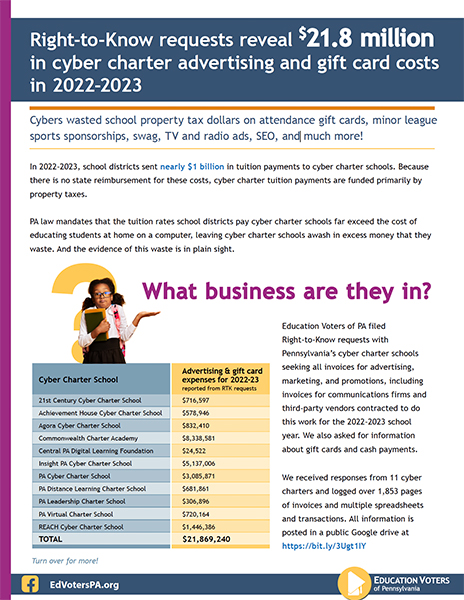

Additional evidence of excess funding and waste is demonstrated by more than 1800 pages of invoices acquired through Right to Know requests that show cyber charters spent more than $21 million on advertising and gift cards during the 2022-2023 school year.

TAKE ACTION

Cyber Charter Asset Hoard Report

Right to Know

Cyber Charter Financials can be downloaded here (Excel Sheet)

In 2021-2022, school districts sent nearly $1 billion in tuition payments to cyber charter schools. Because there is no state reimbursement for these costs, cyber charter tuition payments are funded primarily by property taxes.

PA law mandates that the tuition rates school districts pay cyber charter schools far exceed the cost of educating students at home on a computer, leaving cyber charter schools awash in excess money that they waste. And the evidence of this waste is in plain sight.

State lawmakers could end the excessive profiteering of cyber charter schools with the stroke of a pen. Simple reforms to Pennsylvania’s 25-year-old charter school law that more closely match the tuition districts pay to cyber charters with the actual cost of a cyber charter education would leave cybers with plenty of funding to educate their students and reduce tuition costs for districts. This would mean more money in school district classrooms, less pressure to raise property taxes, and fewer dollars for cyber charter schools to waste.

Unfortunately, state lawmakers have not made commonsense funding reforms that would protect taxpayers from this flagrant waste and abuse of their property tax dollars a priority.